Engagement Options

Engagement Options

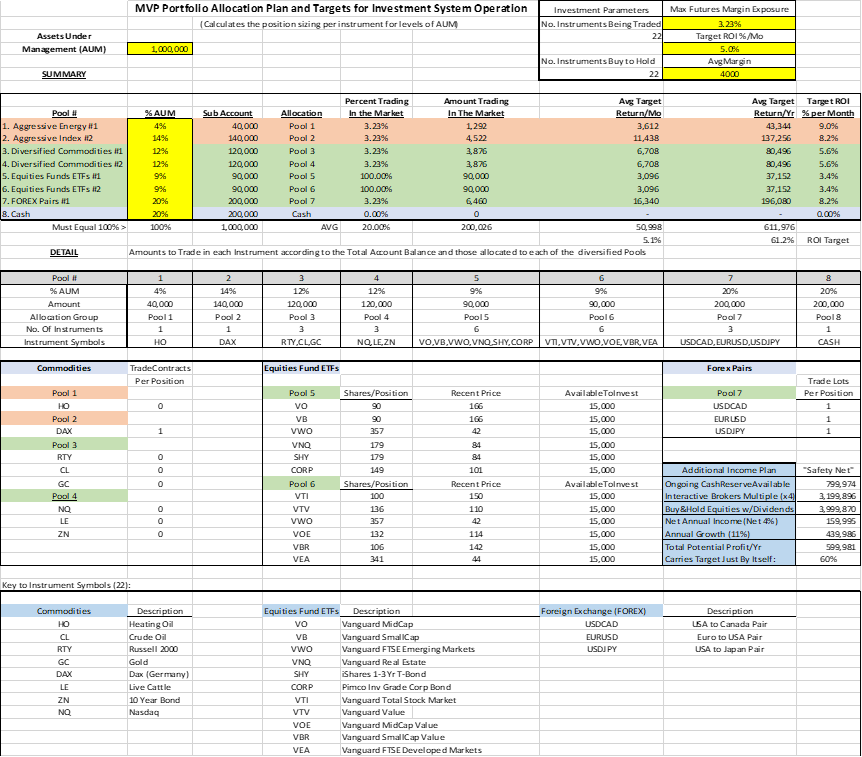

Trading Risk

Our trading risk is designed to limit exposure, while maximizing profits. We do this by only utilizing no more than 5% of your principal to begin with, yet our returns far monthly exceed the S&P yearly returns.

Exposure definition:

Based on a $1MM dollar account, as an example, we start your trading with a 5% exposure (10 contracts traded times the margin* required by the broker at $5,000 per contract, divided by the total account value, $1M X 5% = $50K exposure trading 10 contracts).

Larger accounts would be traded with the same exposure percentages but would trade more contracts proportional to account size.

As profits accumulate, we may increase the exposure by 1% for each time the account balance goes up an additional 5%. The increase in account balance is generated from trade profits, not from additional principal investment (i.e., increase exposure risk placed on accumulated profits, not increase exposure risk on original principal).

Our exposure recommendation is capped at 20% of account value when an account has increased by 50% (you then would be trading 30 contracts at $5,000 margin which would commit $200,000 or 20% of the $1M dollar original principal account to current positions).

The margin requirement per contract is the amount set by the brokerage from the client’s account to trade one contract. This is not what is risked per trade, but rather a good faith ‘account set aside amount’ for each contract currently traded in a position of one or more contracts.

Our

History

Learn more about the company and what makes us work.

Contact

Us

Interested in earning some money with your money? Get in touch.

Media

Appearances

Check out the latest news covering Quantum International.

Our

History

Learn more about the company and what makes us work.

Contact Us

Interested in earning some money with your money? Get in touch.

Media

Appearances

Check out the latest news covering Quantum International.

How We Trade

Risk Per Trade:

When an entry is executed, a stop loss (the dollar amount to risk for that trade) order is immediately sent to the brokerage account of the client at an initial price equivalent to a 1/2 % (of account value) loss on that traded position. For example: ½% X 1M=$5,000, which is the maximum risk to be taken for each trade. The program monitors the total trades open in a position resetting stops or position size as necessary to insure that no single position and its stops is putting more than 2% of account value at risk.

Circuit Breakers:

In the rare event that a string of back to back losses occurs within a trading day, an automatic circuit breaker kicks in to suspend trading for that trading day if and when a cumulative loss for that single day hits 7/10 of 1%. In addition, the account trading has circuit breakers at 5%, 10%, 15% and 20% net loss levels requiring the client’s approval for continuation of the trading at each point, if that happens. Thus, total dollar risk is only whatever of the above percentages the client defines and accepts, with 20% of account value being the maximum.

Account Risk:

We send through our automated system through a written agreement and fee schedule to do so. The client can access their account 24/7 by computer, smartphone, etc. to see trades, balances, etc. They may add or withdraw their money online as like any automated banking system they may currently use. They can also suspend trading by their sole instruction to do so. We only ask for reasonable pre-notification of such actions, so we may adjust trade sizing accordingly.

The

MVP Fund

Our black box trading systems runs in all three commodities markets 23/5 and generate monthly returns that exceed the S&P’s yearly returns. We can show historical returns of 60% per year with no losing trades over the past three years running. We are now accepting clients into our $250 million-dollar MVP Fund, which will generate extraordinary returns for your client’s investment portfolios that far exceed any investments in the market, with minimal risk to their principal.

Our goal is to create funds based on individual players from Major League Baseball, (MLB) National Basketball Association, (NBA) National Football League, (NFL) National Hockey League, (NHL) and European League Soccer, (ELS). We plan to build upon the equity of each fund of the various leagues.

Each fund will open to generate $50 million in Assets Under Management. (AUM) and close. We plan to have 5 separate funds within each sport (Five $50 million-dollar funds, ex. MVP/NBA1, MVP/NBA2, etc…) until we have $250 million in Assets Under Management for each group.

Our initial MVP/NBA Fund will close at $250 million. We will then open our MVP/NFL Fund until we have reached another $250 million. We will continue with our MVP/MLB, MVP/NHL and MVP/ELS Fund based in Europe until we have exceeded our goal of $1 billion in Assets Under Management.

The MVP Strategy is designed for a balance of substantial growth of capital with “Safety Engineering” and total liquidity. The major Strategy Features are as follows;

Growth

1. Approximately 20 % of one’s hard earned liquid capital devoted to the MVP Program (10-20% of one’s total) is applied to active trading in which approximately 20 different financial instruments are bought and sold several times weekly.

2. Of this 20%, approximately 1/8th is allocated to a more aggressive (shorter term) trading program and the remaining 88% to a highly diversified trading program with an overall target net return (net of fees) of 5% monthly.

Liquidity

1. Unlike long-term illiquid investments in projects, real estate, companies, etc., the funds are ALWAYS LIQUID and may be accessed by the owner anytime for any reasons. There are no long-term contracts or commitments… and the risks taken in the trading programs are much less than these other types of investment.

Safety Engineering

1. The client funds will be placed into a master fund (hedge fund) comprised of exclusively MVP Program members. Each member shall own a % of the fund in proportion of their funds to the total. Thus, all monies have the same comprehensive risk management and safety engineering applied to their funds.

2. The 20% of the money in the funds to be trading are divided into 7 trading diversified “Pools”, each of which have built into the totally automated computer program the safety engineering which follows. This protocol includes a maximum 2% risk of any position taken as a portion of the total capital allocated to any single pool.

3. Additionally each pool has a daily “circuit breaker” by which trading is halted (keeping losses small as a percentage of the pool) if that circuit breaker daily loss is hit. Thus, normal losses are kept small so the funds “keep their powder dry” for the larger moves as they occur.

4. The balance of the funds are put into a “Cash” pool which is leveraged into a pool of approximately 20 equities instruments which are purchased for growth and for dividend cash flow. This income and potential future growth on the leveraged cash is designed to achieve the target return of 5% per month on the initial capital ALL BY ITSELF.

This is both a “Safety Net” and buffer for the daily up and down trading results for the 20% of funds engaged in active trading. This allows flexibility in the daily risks taken in the active trading designed to attain, and often necessary for, consistent profitability.